Credit Files – Your Free Credit Report vs Paid – Which Is better For You? (and why…)

Your Free Credit File (or Credit Report) contains vital information about you – but what you get to see depends on if it’s a Paid Credit File or a Free Credit Report …

You probably know you are entitled to check your credit for free right?

And you probably also know that recently, laws were changed meaning you can now check your credit for free every three months…

BUT

What you might not know, is that if you check your

credit for free, that your report may not give you all

the information you really need to see.

Let’s look at what you miss out on, and what you get

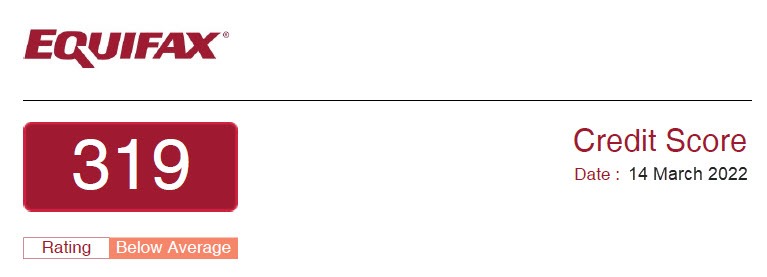

The biggest and most important piece of information missing from a free credit report is your Credit Score

This IS BIG, because many lenders won’t lend to if your score is below a certain level, and it changes depending

on the lender and your circumstances.

The next problem is the potential wait time…

legislation gives them up-to 10 days to provide you with a copy of your credit report…

BUT

That is 10 days AFTER they feel comfortable with your identity being proven. We have seen it take over a month for a client to get his ‘free’ credit file because the

Credit Reporting Body (CRB) kept coming back asking for more proof of his ID.

This can happen if you have an unusual name, a very common name, are a new Australian, or for any number of reasons to hold up your application…

MyCRA Lawyers can get you your paid credit file with your Equifax credit Score within one Business hour, either by you filling in a form, https://mycralawyers.com.au/wp-content/uploads/2021/07/credit-file-request-form-v6.pdf

or – we can take your details over the phone – 1300 667 218

Ask Us How You Can Get Your Credit Default Removed From Just $97 Per Week – Conditions Apply

File Access Information On A Free Equifax Credit Report

There is a big positive for you personally if you get your free credit report or file, and that is the last section on your credit report, The ‘Other Access’ section.

ONLY you get this section. If you ask a broker or lender to get you a copy of your report, their version won’t show the ‘Other Access’ section at all.

So, Why is ‘Other Access’ important?

Well, this shows you who is taking a sneaky little lookie lookie at your credit file, but not as a credit enquiry (which would be recorded in the ‘Enquiries’ section)

Organisations having a sneak peak at your credit file often include Debt Collectors or more accurately, Debt Buyers.

Companies like:

- Credit Corp

- Pioneer Credit

- Baycorp

- Lion Finance

- Panthera Finance

- Transaction Capital etc

These Debt Buyers ‘buy’ your debt from Banks, credit card companies, phone and internet companies, energy companies, and so on…

They then chase you for the full amount of the debt plus fees and interest if applicable.

These Debt Buyers often check your credit file before they make contact with you because they are checking you out to understand your application pattern, your employment history, your assets, and your current address and address history.

They want lots of info because they want to get paid…

Often, a Debt Buyer will show up in your ‘other access’ before you even know you have missed a bill.

Knowing this piece of vital information can help you avoid being defaulted by alerting you that you may have a problem (a missed bill) and allowing you to take positive steps to rectify the issue before your credit report and credit score are negatively tarnished.

My Recommendation Is:

If you are in a hurry to get a loan or fix your credit rating so you can get a loan – Do This Now:

- Complete the Credit File Request Consultation Form

- https://MyCRALawyers.com.au/cfrc

- If you already have your Illion and Equifax credit files, email them to us and

- call Suzie on 1300 667 218 to book an appointment.

You might like to subscribe to our Tiktok and Youtube Channel for credit repair “How To” and “Explainer” Videos and check our Back Catalogue for more gold!

Leave A Comment