That’s The Problem With So-Called ‘Credit Repair Companies’

Coercion, intimidation, lying, and worse still, almost no comprehension!

Firstly, you should understand the background that got me so annoyed, I felt the need to write this article.

Dodgy and Shonky ‘credit repair companies’ are hurting consumers

Yesterday, I was asked by one of our paralegals, to listen to a telephone call between her and a very cranky creditor (we’ll simply call them ‘Creditor’ to respect their privacy). Our team member had never previously experienced this level of unprofessionalism from a creditor. We’ve seen some bad ones, but nothing like this.

This creditor clearly had issues with previous ‘credit repair companies’, and Creditor was not holding back in letting us know exactly what they thought.

It seems that, having never dealt with MyCRA Lawyers before, Creditor assumed we were like all the other ‘dodgy shonks’ out there. Creditor stated, ‘… we know how you work …’ and ‘… this is a shakedown …’ and went on to insist (condensed version) we would simply waste Creditors time in an effort to wear them down so they’d give up and remove the default.

Creditor was adamant that all of the defaults they place on consumer’s credit files are ‘100% correct and in accordance with the law’, and that it’s a waste of their time (it’s a legislated requirement that creditors provide personal information when so requested, this creditor even states on their website that they’d be happy to do so upon request), to have to supply the specific documents we requested (we check to ensure these documents exist and are correct as part of our investigation as it is a legal requirement that the creditor can evidence it has complied with the relevant provisions and legislation) as they knew it was done correctly.

Last Week’s Post…

Regulators Slam Dodgy Credit Repairer

I can’t go into the specifics of the other outlandish claims Creditor made, though suffice to say that there was much worse than I can publish in this article and it was all a reaction to the poor treatment they’d previously received at the hands of unprofessional ‘credit repair companies’.

I have personally now communicated with Creditor, and explained the many differences dealing with MyCRA Lawyers, a Law Firm regulated by the Legal Professions Act 2007 (QLD), that maintains the highest possible accounting standards with a Legal Trust Account that is externally audited every year and reported back to the Queensland Law Society.

Simply as a result of that conversation, Creditor understood that every action taken by MyCRA Lawyers is 100% transparent and accountable. This resulted in a much calmer creditor that was further willing to learn how providing the documents would result in a speedy decision. If Creditor had complied, the default would stay, however if the creditor had erred, the default would require immediate removal.

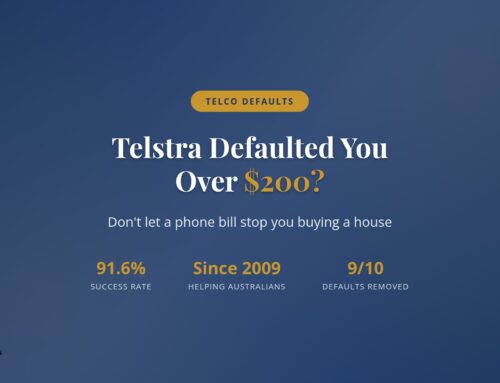

I explained that our historical success rate of up to 91.7%, was the result of ongoing professional relationships forged through countless battles between MyCRA Lawyers and many hundreds of individual creditors.

Many creditors MyCRA Lawyers deals with on a daily basis, now understand that when a request for documents is received, and they can’t locate any part of what is requested, that it’s simpler to remove the default immediately, than go through the full audit process only to still be proven to have placed the default listing unlawfully, and will often offer to remove the default on a no admissions basis.

The problem with so-called credit repairers

Credit repair Shonks are hurting consumers

One of the most alarming issues I see with most of the unregulated ‘credit repair companies’, is not actually the alleged misleading and deceptive conduct they are reportedly engaging in, but the quite simply, their lack of legislative comprehension.

A case in point. Today I became aware of the website of a relatively new player in the credit repairing ‘game’. I will refer to them simply as ‘A’.

A’s business name was only registered 30/07/2015 – (8 weeks ago) and is already claiming ‘… has helped hundreds of people across Australia to fix their credit.’

A’s website goes on to claim, ‘… 10 years’ experience in the finance, credit repair & legal sectors.’

The first thing I noticed about A’s website was the lack of a compliant Privacy Policy.

The Privacy Act 1988 (Cth) (Privacy Act) s 1.3 states, ‘An APP entity must have a clearly expressed and up‑to‑date policy (the APP privacy policy) about the management of personal information by the entity’. Section 1.4 goes on to outline the specific information the Privacy Policy must contain and the ‘Note’ in s 1.5 states, ‘An APP entity will usually make its APP privacy policy available on the entity’s website’.

Question worth thinking about | MyCRA Lawyers 1300-667-218

I would like to pose the following question: If a ‘credit repair company’ is claiming to know, understand and enforce the provisions of the Privacy Act, why would they potentially be in breach of a section of the Privacy Act that has a maximum penalty of up to $1,800,000.

Another question: If these ‘credit repair companies’ actually purport to understand the implications of the Privacy Act, why would A leave itself vulnerable to prosecution under s 11(1) which states, ‘If an APP entity holds personal information, the entity must take such steps as are reasonable in the circumstances to protect the information: (a) from misuse, interference and loss; and (b) from unauthorised access, modification or disclosure.’ by not bothering to protect consumers personal information by spending the money to have a safe and secure SSL Certificate installed?

A has published data collection forms on its website. These forms aim to collect the type of personal information that is regularly collected by Identity Thieves. These forms ask consumers to enter their name, contact information, Driver’s License number, Date of Birth, and credit card information. All very valuable information on the black market and to Identity Thieves!

I’m wondering if the lack of consumer protection on A’s site might be a breach of their merchant facility terms and conditions?

There are so many more issues with this, and other credit repair company websites that I really start to question if these companies really understand that they are playing with people lives.

Here’s another ‘credit repair company’ that claims to have ‘… assisted over 150,000 Australians in taking control of credit ratings …’ and presumably should have a better understanding of the need to protect and secure information entered on their website.

At least this ‘credit repair company’ is trying to secure it’s site, but is using out of date technology that is apparently ‘Weak’, ‘Not Private’, ‘Obsolete’, ‘Not Secure’ and ‘Can Be Viewed By Others While In Transit’.

Here is a link to better understand what the different coloured padlocks mean in the browser address bar. https://support.google.com/chrome/answer/95617?p=ui_security_indicator&rd=1

So, as I see it, The Problem With So Called Credit Repairers starts with the lack of regulation. There is currently NO regulation specific to a ‘credit repair company’, which is possibly why there are so many complaints and allegations of dodgy shonks, misrepresentation, etc., etc..

Did you know MyCRA Lawyers is the ONLY law firm in Australia, 100% specialising in helping our clients, people just like you, remove or correct credit reporting mistakes to remove bad credit default listings.

That’s right, MyCRA Lawyers does NOTHING else, so our full attention is always on you, utilising and improving our tested and proven systems, custom designed specifically to increase and maximise your chances of having your bad credit default listings legally removed.

The final question I will pose here is this: If these few examples are in any way an indication of the quality and calibre of ‘credit repair companies’ in general, can you honestly afford to risk putting your faith, and the faith of your clients in their hands with something as important, and as fragile as your credit rating?

I look forward to the expert team at MyCRA Lawyers helping you as soon as you pick up the telephone and dial 1300-667-218 for a free, no obligation consultation where we can take the time to listen, and fully understand your specific circumstances. Only then, can we give you the honest, reliable and trustworthy advice you expect from a law firm.

“Thank you so much I will tell all my Doctor friends, family, and I will recommend them to you.”

“… for me impossible to get any loan, without your help …”

“… And Lauren Andrew, ahhh Phillip Anthony, Cory – they are all amazing, you know? I can’t tell you how beautiful the service was, it’s amazing, it’s changed my life. It’s changed my life and it’s saved me thousands of dollars because you know the bank wanted to give me 10% because of my credit file. My excellent, my credit history now, it’s back on track…” Dr Kamal Zgheib – Qld

Thank you so much for a great service that was professional and very prompt.

thanks a lot for stellar results on the client I referred Friday. Credit Card Default from a trigger happy major was removed in 3 days. Impressive

I would like to inform you that, after spoken to you yesterday, I called Veda and they told me that my credit default has been removed. I also ordered for my new credit report and indeed the Optus default listing was not there, plus my credit score went up 546 – 716%. I Just want to thank you guys for following up

Thank you

Thank you very much for your prompt handling of this matter. Thank you also to Corey who saved me a lot of to and throw (billing minutes) by quickly accessing my file for an up-to-the-minute update, supported by ‘NOW’ emails regarding progress, including clear understandable trust account billing.I found it very refreshing get have an ‘off the record’frank discussions drawing on the experience of the team to be absolutely golden! I was able to carry on with business, rest assured myCRA Lawyers had everything under control.

MyCRA delivered on time and on budget.

Top Job Guys!! I will gladly recommend MyCRA Lawyers to family and friends in the future

I contacted MyCRA Lawyers after being off work with an injury.

It started by missing a couple of small payments, power, phone then an existing loan I had.

Still unable to return to work, things started to compound exponentially and before I knew it I started getting calls from up to 3 different debt collectors 5 times a day.I felt powerless to do anything about it and decided to give Graham Doessel at MyCRA Lawyers a call. Within the first week Graham and his expert team had completely removed the $1000 debt but more importantly, the default listing from VEDA. Their high success rate of removing defaults, combined with their extensive knowledge of debt collectors not adhering to certain rules they must follow means the defaults can be removed quicker than you would expect.

I would certainly recommend their services, and can’t tell you how satisfied you feel when the burden is lifted.

Past results are no indication of future success.

Leave A Comment