[fusion_builder_container type=”flex” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” border_style=”solid”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” border_style=”solid” border_position=”all” spacing=”yes” background_repeat=”no-repeat” margin_top=”0px” margin_bottom=”0px” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”true” hover_type=”none” first=”true”][fusion_text]

Understanding creditor default removal timeframes is crucial for anyone with a damaged credit file. If you’ve ever wondered why some people get their defaults removed in days while others wait months, the answer isn’t luck—it’s about which creditor listed the default.

Understanding Creditor Default Removal Timeframes in Australia

Not all creditors operate the same way. They have different processes, different compliance standards, and different attitudes toward default removal requests. Many respond quickly and cooperatively, while others drag their feet and fight every step of the way.

After 16 years of helping Australians repair their credit files, we’ve developed deep insights into exactly which creditors fall into which category. Here’s what makes the difference.

The Four Factors That Determine Creditor Default Removal Speed

1. Compliance Culture

The first major factor is a creditor’s internal compliance culture.

Some creditors maintain tight compliance processes. They keep meticulous records and follow the rules carefully when listing defaults. When you challenge them, they can quickly pull up the documentation and either defend the listing or acknowledge an error.

Other creditors have sloppy compliance standards. Their records are incomplete, and their processes are inconsistent. When you challenge them, they scramble to find paperwork that may not exist.

Interestingly, sloppy creditors can be easier to deal with in some ways—they can’t defend what they can’t prove. However, they can also be slower because their internal processes are disorganised and chaotic.

Want to Know Your Chances?

We can assess your situation and tell you how long removal might take.

or call 1300 667 218

For more information about your rights under Australian credit reporting law, see the Office of the Australian Information Commissioner (OAIC) and the Australian Financial Complaints Authority (AFCA).

2. Established Relationships

Over 16 years, MyCRA Lawyers has built relationships with key contacts inside major creditors. We know who to talk to, how their internal processes work, and what they need to see to make a decision.

When we reach out to a creditor we’ve dealt with hundreds of times before, we’re not starting from scratch. We’re not getting lost in a call centre queue. Instead, we go directly to the people who can actually make things happen.

This is why we’ve had defaults removed in as little as 14 minutes with some creditors. We knew exactly where to go and what to say to expedite the process.

3. Creditor Attitude Toward Disputes

Creditors take vastly different approaches when responding to disputes.

Some creditors adopt a commercial approach. They weigh up the cost of fighting a dispute against the cost of simply removing the listing and moving on. If we present a solid case backed by evidence, they’ll often agree to remove the default rather than drag things out.

Other creditors fight everything on principle. They’ll defend listings even when their position is weak and escalate matters to external dispute resolution rather than concede. These creditors take longer—not because the case is harder, but because they choose to make it harder.

4. Whether the Debt Has Been Sold

If the original creditor still owns the debt, there’s one party to deal with. However, if someone sold the debt to a debt buyer, the process can become more complicated because documentation often goes missing during the transfer.

That said, debt buyers have their own compliance vulnerabilities that experienced credit repair lawyers understand. Very often, if your debt has been sold, this can actually help get your default removed faster due to documentation gaps in the chain of ownership.

What Creditor Default Removal Means for Your Credit Repair Journey

When we assess a client’s credit file, we don’t just look at what’s listed—we look at who listed it.

We know which creditors typically resolve matters in 7 days. We know which ones average 30 days. Furthermore, we know which ones might take 90 days or more. This knowledge helps us set realistic expectations and prioritise work based on each client’s specific needs.

If you need a default removed quickly because settlement on a property is approaching, we can tell you whether that’s realistic based on which creditor we’re dealing with. This honest assessment prevents disappointment and allows for proper planning.

Not All Defaults Are Created Equal

The key takeaway about creditor default removal is that not all defaults are equal, and not all creditors are equal. The name next to the listing on your credit file matters more than most people realise.

Understanding these dynamics is crucial for anyone dealing with defaults on their credit report. While you might be tempted to tackle credit repair yourself, having professionals who understand the nuances of each creditor’s processes can significantly impact both the outcome and the timeframe.

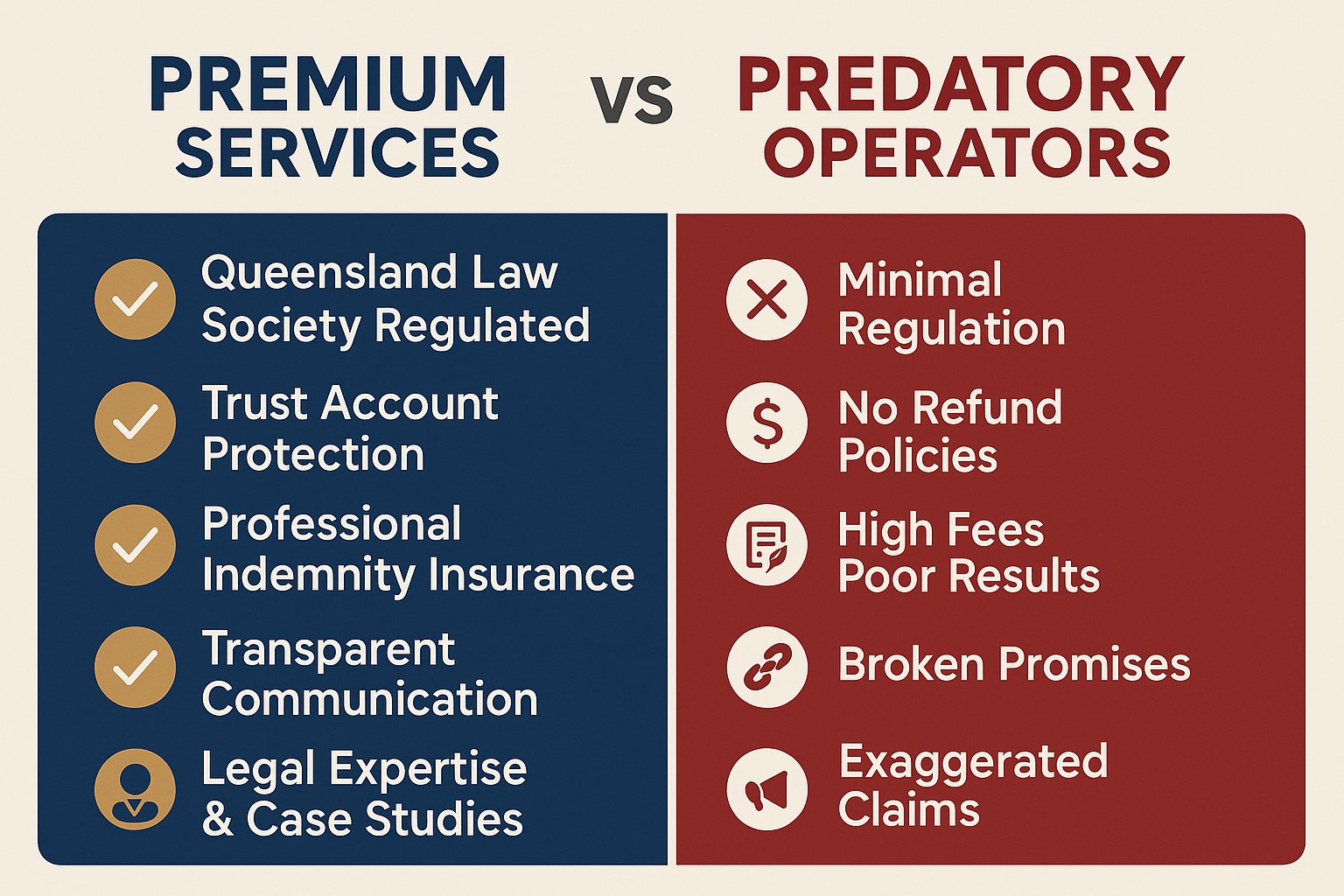

The Advantage of Legal Representation

As a law firm, MyCRA Lawyers has capabilities that standard credit repair companies simply don’t possess. We can take legal action when necessary, which gives creditors additional incentive to respond appropriately and promptly to our requests.

Our 16 years of experience means we’ve seen every type of creditor behaviour and developed strategies to handle each situation effectively. We know which creditors respond to which approaches, and we tailor our strategy accordingly.

Taking the Next Step

If you’re dealing with defaults on your credit file, understanding these factors can help you make informed decisions about how to proceed. Whether you choose to work with professionals or attempt to resolve matters yourself, knowing what to expect from different creditors is valuable information.

For those considering professional assistance, a consultation can help you understand the realistic timeframes for your specific situation based on which creditors are involved. This knowledge allows you to plan accordingly, especially if you have time-sensitive financial goals like property settlement or loan applications.

Conclusion

Default removal timeframes vary significantly based on four key factors: the creditor’s compliance culture, established relationships with key contacts, their attitude toward disputes, and whether someone sold the debt. Understanding these factors helps set realistic expectations and develop effective strategies for credit repair.

The creditor’s name on your default listing is one of the most important factors determining how quickly—and successfully—that default can be removed. Armed with this knowledge, you can make better decisions about your credit repair journey.

Ready to Get Your Defaults Removed?

Don’t let bad credit hold you back. Our specialist lawyers have helped thousands of Australians remove unfair defaults and rebuild their financial future.

📞 1300 667 218 | Australia-wide service

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_imageframe][fusion_separator style_type=”none” top_margin=”20″ bottom_margin=”10″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” class=”” id=”” /][fusion_text]

[/fusion_imageframe][fusion_separator style_type=”none” top_margin=”20″ bottom_margin=”10″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” class=”” id=”” /][fusion_text]