[fusion_builder_container background_color=”” background_image=”https://mycralawyers.com.au/wp-content/uploads/2013/08/Optimized-bad-credit.jpg” background_parallax=”fixed” enable_mobile=”yes” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”center center” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” video_mute=”yes” video_loop=”yes” fade=”no” border_color=”” border_style=”solid” padding_top=”40″ padding_bottom=”40″ padding_left=”0px” padding_right=”0px” hundred_percent=”yes” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=”” type=”flex” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px”][fusion_builder_row][fusion_builder_column type=”1_6″ layout=”1_6″ last=”false” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”true” spacing_right=”2%” min_height=”” type=”1_6″][/fusion_builder_column][fusion_builder_column type=”2_3″ layout=”2_3″ last=”false” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”solid” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”false” spacing_right=”2%” spacing_left=”2%” min_height=”” type=”2_3″][fusion_text]

How Do Bad Credit Defaults Get Removed…

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_6″ layout=”1_6″ last=”true” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”false” spacing_left=”2%” min_height=”” type=”1_6″][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container background_color=”” background_image=”” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” video_mute=”yes” video_loop=”yes” fade=”no” border_color=”” border_style=”” padding_top=”20″ padding_bottom=”20″ padding_left=”” padding_right=”” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=”” type=”flex” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px”][fusion_builder_row][fusion_builder_column type=”1_6″ layout=”1_6″ last=”true” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”true” spacing_right=”2%” min_height=”” type=”1_6″][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”2_3″ last=”true” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”true” spacing_right=”2%” spacing_left=”2%” min_height=”” type=”1_1″][fusion_text columns=”” column_min_width=”” column_spacing=”” rule_style=”default” rule_size=”” rule_color=”” content_alignment_medium=”” content_alignment_small=”” content_alignment=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” class=”” id=”” font_size=”” fusion_font_family_text_font=”” fusion_font_variant_text_font=”” line_height=”” letter_spacing=”” text_color=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]How do defaults get removed

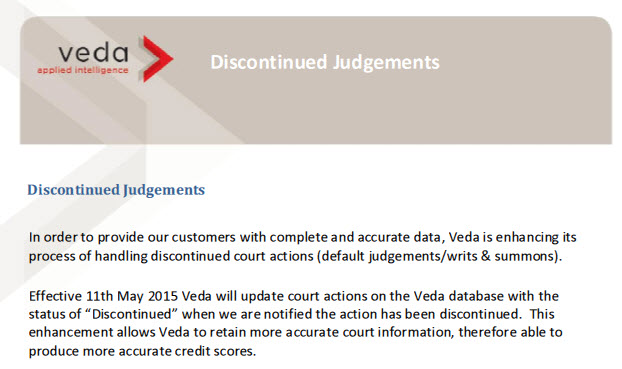

1.) Firstly, [fusion_popover title=”Tell Us What Really Happened” title_bg_color=”” content=”Tell us what really happened – not what you think will help, or what you think we might want to hear. Why Is This Important? The more information we have, the better your chances of MyCRA Lawyers legal team finding a reason to remove the bad credit listing. Also, if you don’t tell us everything, we may formulate an approach based on the information you provide that could turn out to be a waste of your time and your money. This may also limit your chances at a second approach or attempt.” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”Right” class=”” id=””]we ask you what really happened[/fusion_popover] so we understand your specific situation.

2.) We then confirm the listings on your [fusion_popover title=”Credit Files” title_bg_color=”” content=”There Are Four Main Credit Reporting Bodies In Australia: Veda Advantage (Veda), Dun & Bradstreet (DnB), Experian and Tasmanian Collection Service. MyCRA Lawyers routinely removes defaults, Court Judgments and other bad credit listings from your Veda and DnB credit reports. MyCRA Lawyers can help you get a copy of both your Veda and your DnB credit files while you’re on the phone with us.” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”Right” class=”” id=”credit-files”]Credit Files[/fusion_popover] to further assess your specific situation.

3.) You are then advised the most appropriate course of action, [fusion_popover title=”Not All Defaults Need To Be Investigated” title_bg_color=”” content=”Once we have had a look at your full credit file, we can advise you on the best options available to you. This may include an alternative action that you can do yourself at no charge, or sometimes to do nothing at all. Doing nothing may be the best option if for example, the default listing has almost run it’s course and is about to be automatically deleted by the credit reporting body due to the passage of time.” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”Right” class=”” id=””]including which defaults Do NOT need to be investigated[/fusion_popover].

4.) Then we request from your creditor(s), a list of [fusion_popover title=”Specific Documents” title_bg_color=”” content=”The specific documents requested are those that relate to notices sent to you, information on your file, when specific actions were taken, histories of the account, histories of the payment and missed payments etc. Your creditor is required to have copies of these documents.” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”Right” class=”” id=””]specific documents[/fusion_popover] and information about your file and history with them.

5.) We then review the information provided by both you and your creditor, and compare that with up to approximately 8000 pages of legislation, looking for [fusion_popover title=”Legislative Breaches” title_bg_color=”” content=”Legislative or Compliance Breaches may deem the credit file listing unlawful and require it’s immediate removal.” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”Right” class=”” id=””]legislative and/or compliance breaches[/fusion_popover].

6.) We then uncover those legislative or compliance breaches and advise your creditor that the default listing has been placed unlawfully and needs to be removed immediately. [fusion_popover title=”Australia’s Only Audited Success Rate” title_bg_color=”” content=”We know you’ve probably heard all the horror stories about the dodgy ‘credit repair companies’ ripping people off and making unsubstantiated claims, so we decided to have the same Auditor that does our annual Law Firm Trust Account Audits (As required by The Queensland Law Society) take a look at, and formally Audit or Successful Removal Resolution Results. The Auditor came back with the Audit Certificate confirming MyCRA Lawyers is successful in achieving a removal resolution in 91.6% of matters fully investigated. (The certificate is available on our website if you’d like even more assurance that MyCRA Lawyers is the only safe choice in investigating the validity of listings on your credit rating.)” content_bg_color=”” bordercolor=”” textcolor=”” trigger=”hover” placement=”Right” class=”” id=””]This happens in 91.6% of cases.[/fusion_popover].

7.) You are then advised of the successful default removal resolution. 29.6% of the successful removal resolutions are achieved in seven days or less.

8.) Once your creditor has acknowledged the removal request, the default is normally permanently removed from your credit file(s) in just 10 business days.

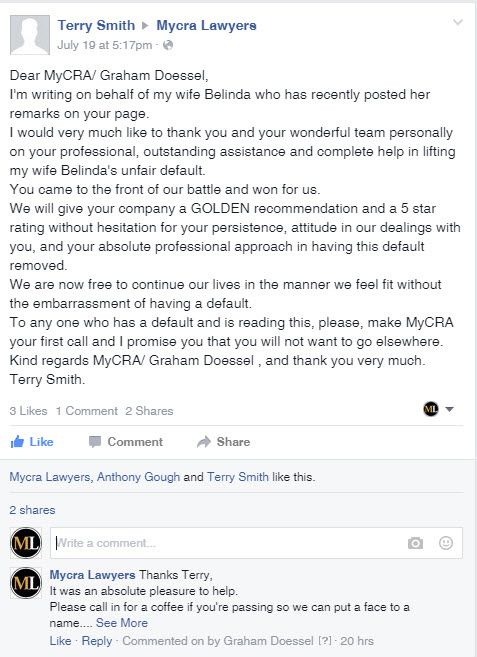

You can then go on to apply for your home loan or finance and move in to your very own family home.

To get started, Pick up your phone now and call MyCRA Lawyers now on 1300-667-218 for a 100% confidential, no obligation free chat.

[/fusion_text][/fusion_builder_column][fusion_builder_column type=”1_1″ layout=”1_6″ last=”true” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”true” spacing_left=”2%” min_height=”” type=”1_1″][fusion_text]

If you’d like more information

or just want to chat about your situation, please call 1300-667-218 and speak confidentially with one of our friendly, helpful team. There is no cost and no obligation.

[/fusion_text][fusion_button link=”” color=”default” size=”medium” stretch=”” type=”3d” target=”_self” title=”Arrange a call back” button_gradient_top_color=”” button_gradient_bottom_color=”” button_gradient_top_color_hover=”” button_gradient_bottom_color_hover=”” accent_color=”” accent_hover_color=”” bevel_color=”” border_width=”” icon=”fa-phone-square” icon_position=”left” icon_divider=”no” modal=”call_back” animation_type=”0″ animation_direction=”left” animation_speed=”1″ animation_offset=”” alignment=”center” class=”” id=”” border_radius=”25″]No Time Now? – Click To Arrange A Call Back[/fusion_button][fusion_modal name=”call_back” title=”We Can Call You Back” size=”large” background=”#ffffff” border_color=”#c4c4c4″ show_footer=”no” class=”” id=””][contact-form-7 id=”6642″ title=”Online Enquiry”][/fusion_modal][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_imageframe][fusion_text]

[/fusion_imageframe][fusion_text] [/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][fusion_imageframe lightbox=”no” lightbox_image=”” style_type=”none” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”none” link=”” linktarget=”_self” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ hide_on_mobile=”no” class=”” id=””]

[/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][fusion_imageframe lightbox=”no” lightbox_image=”” style_type=”none” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”none” link=”” linktarget=”_self” animation_type=”0″ animation_direction=”down” animation_speed=”0.1″ hide_on_mobile=”no” class=”” id=””]  [/fusion_imageframe][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_imageframe][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]