Media Release

Australians on ‘credit-collision course’ without better education.

Australians on ‘credit-collision course’ without better education.

15 October 2013

A consumer advocate for accurate credit reporting hopes the introduction of a public scoring system from Veda Advantage will be the catalyst to boost dangerously low credit awareness and reduce the likelihood of credit disasters following the implementation of new Privacy Laws next year.

Graham Doessel, CEO of credit repair company MyCRA says the Veda credit score is calculated from interpreted data at Australia’s biggest credit reporting agency, Veda Advantage – and has up till now been used by many lenders to assess credit worthiness.

“This information is now available to consumers, and this is a positive step in terms of transparency,” Mr Doessel says.

“But what I am most hoping will happen, is that more Australians will find this new number an easy and attractive starting point to finding out more about managing their own credit-worthiness.”

He warns if we don’t facilitate credit-savviness now, possibly millions of Australians could be severely disadvantaged come March 2014 when new data sets are available on Australian credit reports.

“The need for knowledge is going to be greater next year, as more people are going to get caught out with a bad credit score, and be scratching their heads to understand why,” he warns.

Recently Veda Advantage released results of its analysis of 300,000 VedaScores with consumer research of 1,000 Australians, and found that an astounding 80% of people had never accessed their credit report.

“…despite 15% of Australians being at risk of a credit default being recorded on their credit report in the next 12 months, considerable lack of awareness exists about what a credit history is, or how a poor credit report can impact chances of getting credit from lenders,” Belinda Diprose, Veda Marketing Manager says.

Mr Doessel says it demonstrates an alarming rate of ignorance in the community.

“It’s not really the fault of consumers. In my opinion there has not nearly been enough emphasis on public credit education right across the board up until quite recently,” he says.

Mr Doessel says there are some important basics about their credit rating that Australians should know.

5 Things You Need To Know To Manage Your Credit Worthiness.

1. You don’t have to pay to see your credit file, just your credit score.

In most cases you can access your credit file for free annually from all of Australia’s credit reporting agencies, and this will remain at a standard 10-day issue from receipt of application. It is important to apply for your credit file with each credit reporting agency – as you may have defaults with only one company. They are: Veda Advantage, Dun & Bradstreet, Tasmanian Collection Services, and Experian.

2. Your credit score rates you based on other credit-active Australians.

Your credit score based on Veda data will be available to you when you pay to see your VedaScore with your credit report, via this particular credit reporting agency. Veda Advantage holds roughly 16.5 million Australian credit files – so the data should be quite predictive of your overall credit worthiness in comparison to other credit-active Australians. If you are applying for credit in the near future, this credit score could be important to know.

3. There are several factors that make up your credit-worthiness.

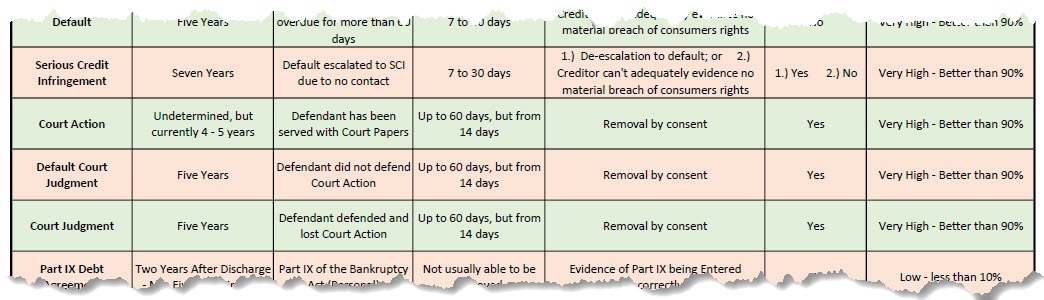

Items such as negative credit listings (defaults, Court Writs, Judgments and Bankruptcies); number of credit enquiries and the type and size of credit requested in your past application can all impact your credit worthiness.

But there are other pieces of information about you which also have a bearing on your credit score – including your address; your age; how long you’ve lived at your current address; any business directorship or partnership you have, and the address of the business and length of time there.

Information on the VedaScore calculation can be found on Veda’s website.(1)

4. There will be more factors affecting your credit-worthiness next year.

As of March 2014, there will be 5 new data sets available on Australian credit reports, and this data will be used in any credit score calculation.

They are: repayment history information; the date on which a credit account was opened; the date on which a credit account was closed; the type of credit account opened; and the current limit of each open credit account.

5. Late payments will impact your credit file.

You will still be defaulted if you are more than 60 days late in making repayments to any Credit Provider, but in addition if you are more than 5 days late paying a licenced Credit Provider, you will be issued a late payment notation and this will show on your credit file from March 2014.

Repayment history information applies to credit such as loans and credit cards and is being collected NOW. Too many late payments will more than likely reduce your credit score significantly.

Mr Doessel says better credit education should eventually lead to fewer inconsistencies in credit reporting.

“Credit rating errors are quite common, and the onus of ensuring the credit file is accurate rests with the consumer – so better education across the board could result in more errors being ironed out in the credit reporting systems,” he says.

/ENDS.

For interviews please contact:

Graham Doessel – CEO Ph 3124 7133

For media enquiries please contact:

Lisa Brewster – Media Relations media@mycra.com.au

Ph 07 3124 7133 www.mycra.com.au www.mycra.com.au/blog

MyCRA Credit Repair 246 Stafford Rd, STAFFORD Qld

MyCRA is Australia’s number one in credit rating repairs. We permanently remove defaults from credit files. CEO of MyCRA Graham Doessel is a frequent consumer spokesperson for credit reporting issues and is a founding member of the Credit Repair Industry Association of Australasia.

(1) http://www.veda.com.au/yourcreditandidentity/check/vedascore/how-my-vedascore-calculated

Unsubscribe me from this list

Image: nuttakit/ www.FreeDigitalPhotos.net

[/fusion_imageframe][fusion_separator style_type=”none” top_margin=”20″ bottom_margin=”10″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” class=”” id=”” /][fusion_text]

[/fusion_imageframe][fusion_separator style_type=”none” top_margin=”20″ bottom_margin=”10″ sep_color=”” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” class=”” id=”” /][fusion_text]

Okay, so the G20 starts today and some people really don’t know much about what is really going on.

Okay, so the G20 starts today and some people really don’t know much about what is really going on.