[fusion_builder_container type=”flex” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” border_style=”solid”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” border_style=”solid” border_position=”all” spacing=”yes” background_repeat=”no-repeat” margin_top=”0px” margin_bottom=”0px” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”true” hover_type=”none” first=”true” background_blend_mode=”overlay”][fusion_text hide_on_mobile=”small-visibility,medium-visibility,large-visibility” sticky_display=”normal,sticky” animation_direction=”left” animation_speed=”0.3″ animation_delay=”0″]

What ASIC’s Probe Into Debt Management And Credit Repair Services And Investigation Reveals About Premium vs. Predatory Credit Repair Services

By Graham Doessel, CEO, MyCRA Lawyers

22 July 2025

ASIC’s recently announced investigation into debt management and credit repair services has sent shockwaves through the industry. As someone who has been helping Australians with credit repair since 2009, I believe this investigation actually validates what we’ve been saying for years: not all credit repair services are created equal.

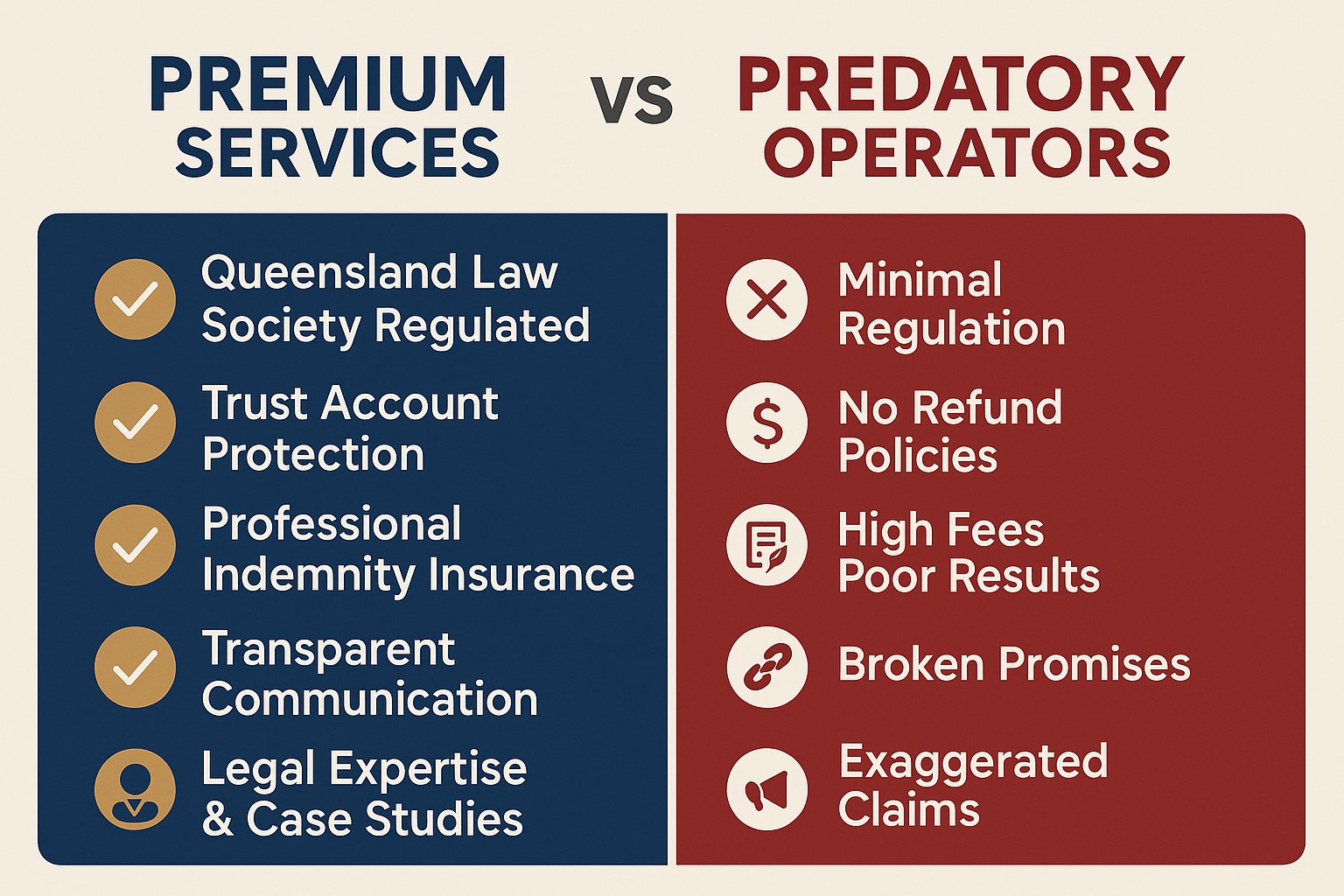

The stark reality is that ASIC’s probe exposes a troubling divide in our industry – one that distinguishes between legitimate, premium legal services and predatory operators who exploit Australia’s most vulnerable consumers.

The Predatory Pattern ASIC Has Identified

ASIC Commissioner Alan Kirkland’s announcement paints a disturbing picture of industry practices that should concern every Australian considering credit repair services. The regulator has identified several red flags that define predatory operators:

- High fees for no or limited services – Companies charging substantial amounts while delivering minimal results

- Broken promises to vulnerable consumers – Making commitments they cannot or will not keep

- Poor communication – Leaving clients in the dark about their cases and progress

- No-refund policies – Refusing to return money even when services are not delivered

“In one instance, we heard that a woman could not get an answer on why her debt management firm was not making any payments to her creditors. After numerous calls to the firm, she was told to enter into bankruptcy with no further explanation.”

– ASIC Commissioner Alan Kirkland

These examples highlight a crucial distinction: predatory operators specifically target people in active financial hardship – those who can least afford to lose money on ineffective services and who are most desperate for help.

Why Premium Pricing Actually Protects Consumers

At MyCRA Lawyers, we operate on a fundamentally different model, and ASIC’s investigation helps explain why our approach actually protects consumers rather than exploiting them.

Our Clients Are No Longer in Financial Hardship

This is perhaps the most critical difference that ASIC’s investigation highlights. Our legal fees are necessarily higher because we provide qualified legal services delivered by professionals regulated by the Queensland Law Society. But here’s what that means in practice: our clients are typically people who are back on their feet financially, but still dealing with the lingering effects of past credit issues.

These aren’t vulnerable people in active financial crisis – they’re individuals who have recovered economically and can now afford professional legal representation to address remaining credit file problems. The premium pricing acts as a natural filter, ensuring we work with clients who are financially stable enough to invest in proper legal remediation.

Professional Accountability vs. Regulatory Gaps

While ASIC is investigating approximately 100 licensees operating under the 2021 debt management licensing regime, firms like ours operate under a different and more stringent regulatory framework. Since incorporating MyCRA Lawyers in 2013 (building on my credit repair experience dating back to 2009), we’ve been subject to Queensland Law Society regulation, professional indemnity insurance requirements, and strict trust account obligations.

This means:

- Client funds are protected in regulated trust accounts

- Professional conduct is monitored by the Legal Services Commission

- We’re required to maintain professional indemnity insurance

- Continuing legal education ensures we stay current with consumer credit law

Legal Expertise Delivers Genuine Results

The investigation also reveals how some operators make exaggerated claims about their success rates. Chapter Two Holdings was recently fined for falsely claiming to have “wiped $80 million in debt” – the kind of marketing hyperbole that should immediately raise red flags for consumers.

In contrast, our case studies demonstrate real legal processes with genuine outcomes. When we helped Jason remove his Westpac/Baycorp default in 491 days, it was through legitimate legal complaints raising issues like missing section 88 notices, inadequate credit guides under section 160 of the National Consumer Credit Protection Act, and breaches of general conduct requirements under section 47.

These aren’t marketing claims – they’re documented legal processes that achieve results because they’re grounded in actual consumer credit law expertise.

Transparency vs. Exploitation

Another key differentiator that ASIC’s investigation highlights is the issue of transparency and communication. While the regulator found examples of firms that couldn’t explain their lack of progress to clients, we’ve built our practice around the opposite approach.

Through our social media channels, including our TikTok account https://tiktok.com/@mycralawyers, we provide free credit repair guidance to thousands of Australians. This isn’t just marketing – it’s a demonstration of our willingness to educate consumers and share knowledge freely, even when it doesn’t directly benefit our business.

This transparency extends to our client communications, where we explain not just what we’re doing, but why specific legal strategies are being employed and what outcomes can realistically be expected.

The Premium Service Difference

ASIC’s investigation reveals that predatory operators often target consumers who are still struggling financially, promising quick fixes and unrealistic outcomes. Our premium model serves a different population entirely – people who have moved beyond immediate financial crisis and are now in a position to invest in professional legal services to clean up their credit files.

This fundamental difference in clientele explains why premium pricing actually serves as consumer protection. When someone can afford legal fees, it typically means they’re no longer in the desperate financial circumstances that predatory operators exploit. They can make informed decisions about professional services rather than grasping at unrealistic promises driven by financial desperation.

What This Means for Australian Consumers

ASIC’s investigation should serve as a wake-up call for consumers considering credit repair services. The regulatory probe validates what experienced legal professionals have long understood: there’s a world of difference between qualified legal representation and operators who may be taking advantage of vulnerable people.

As Commissioner Kirkland noted, “We have heard numerous accounts of debt management firms making promises to vulnerable consumers that may not have been kept.” This investigation represents ASIC’s commitment to protecting consumers from predatory practices, but it also highlights the importance of consumers making informed choices.

Making the Right Choice

If you’re considering credit repair services, ASIC’s investigation provides important guidance on what to look for – and what to avoid. Choose providers who are transparently regulated, who can demonstrate genuine legal expertise, and who work with clients who are financially stable rather than targeting those in crisis.

At MyCRA Lawyers, our team have been helping good people out of bad situations since 1997 and as MyCRA lawyers since 2013. Our premium service model ensures we work with clients who are ready to invest in professional legal representation to achieve lasting credit file improvements.

For free credit repair guidance and to learn more about legitimate credit repair processes, visit TikTok.com/@mycralawyers or call us on 1300 667 218.

The Path Forward

ASIC’s investigation will undoubtedly lead to increased scrutiny of the credit repair industry, and that’s a positive development for legitimate operators and consumers alike. As the regulator works to strengthen practices across the sector and address potential consumer harm, the distinction between premium legal services and predatory operators will become even clearer.

For over 15 years, we’ve built MyCRA Lawyers on the foundation that good people sometimes find themselves in bad situations through no fault of their own. ASIC’s investigation confirms that choosing the right professional representation – someone bound by professional obligations, regulated by legal authorities, and committed to transparent practices – makes all the difference in achieving genuine, lasting credit repair outcomes.

The credit reporting system in Australia may be “grossly unfair to good honest Australians,” as I’ve often said, but ASIC’s investigation proves that not all credit repair services are created equal. Choose wisely, and choose professionals who are accountable to both their clients and their regulatory bodies.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]