[fusion_builder_container hundred_percent=”no” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” overlay_color=”” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” padding_top=”” padding_bottom=”” padding_left=”” padding_right=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_size=”” border_color=”” border_style=”solid” border_position=”all” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” center_content=”no” last=”no” min_height=”” hover_type=”none” link=””][fusion_text]

Hi,

Did you see these case studies? I sent this follow up email last week but I think the response may have slowed the server so I thought I’d send it again just in case you hadn’t had a look yet 🙂

We have Hundreds more Case Studies on our blog, and here’s a few as an example:

Previously we sent you: Toyota – CBA/Panthera – Vodafone – Council Judgment

|

|

|

|

| Default Removal Resolution in just 7 days | Default Removal Resolution in just 42 days | Default Removal Resolution in just 10 days | Default Removal Resolution in just 63 days |

Click the images above to take a look at the full Case Study.

Call 1300 667 218 today and talk to us about your situation. We can take a look at your credit file and let you know if we feel we can help you.

Call my team now on 1300 667 218

Before you go, scroll down through the additional info in this email because you might find some of it helpful and useful

Graham

Links: The Sanity Space | SBAA | A.D.S. Law | Family Law Five | Online Referral Form | FAQ’s | View web version |

*******************************************************

Remember, until the end of January, anyone who uses this new simple form contained within the new page will save up to *58.6% off our Solicitors Standard Hourly Rate – so CLICK HERE give it a try today and don’t miss out on savings of up to 58.6%!

*******************************************************

P.S. here are some extra links

- Refer a client or friend CLICK HERE

- The Info Page BEFORE the new simple form CLICK HERE

- The new simple form (direct link) CLICK HERE

PPS. I hope we have your Mobile number correct (None Supplied)

You might like to reply to this email with your up-to-date- contact details

Thanks

Warmest regards,

MyCRA Lawyers

Graham Doessel

Chief Executive Officer

Tel: 1300 667 218

*************************************

have a look at a few previous success stories (Case Studies)

*************************************

Links: Sanity Space | SBAA | ADS Law | Family Law FIVE | Referral Form | View web version |

If the phones are busy please keep trying, as these amazing saving will be snapped up fast, so don’t you be the one to miss out…

To help you decide, where we help you is…

- If you have bad crèdit; and

- If you want a clean crèdit rating in early 2019; and

- If you want the safety, surety, and confidence of Lawyers; and

- If you want the best value for your money,

Then doesn’t it make good sense to get started with MyCRA Lawyers? It does, doesn’t it?

*************************************

have a look at a few previous success stories (Case Studies)

*************************************

So, if your home loan was declined and you missed out on the perfect home because of your bad crèdit rating that no one told you could be fixed by MyCRA Lawyers, then looking back maybe you’d say you’d have paid anything to have the default removed right?

So rather rather than wait for more bad news, why not get started on your credit repair with MyCRA Lawyers Now at our best value ever and let us do all the work so you can have a clean credit rating in 2019?

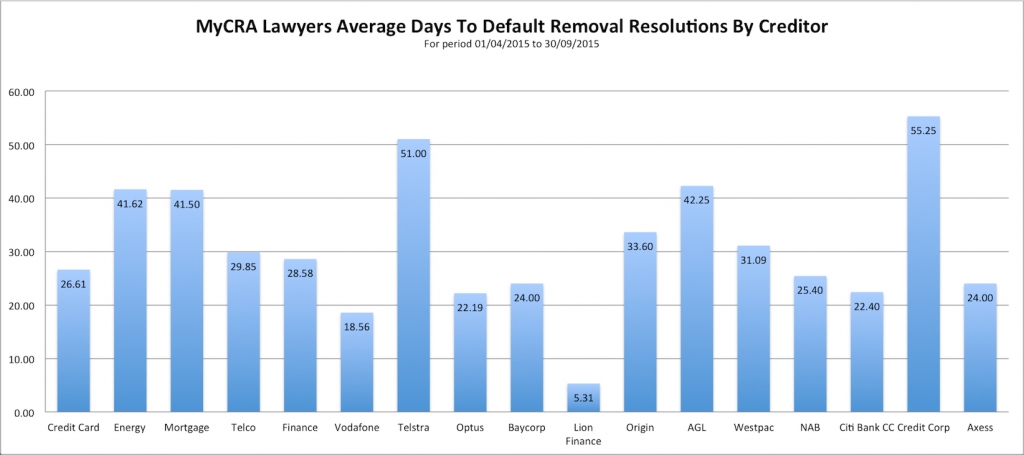

If you can recall, I’ve been helping people fix their credit ratings since 26 November 2009 (I tested the idea from September 2009 and registered the company 26 Nov 2009), so I believe I’ve got the most experience, knowledge and success in credit repair in Australia, in MyCRA Lawyers, and this is backed up by:

- Our fastest Default Removal Resolution in just 17 minutes from our first email to the creditor to receiving confirmation that the default would be removed

- Being able to prove our 91.6% Default Removal Resolution Success Rate

- The growing number of glowing client reviews, and

This all means that MyCRA Lawyers has come to be known as the premium choice if you want your credit repaired properly, in the shortest possible time, and with the least amount of work required from you (we ask you a few questions and then seek the information from your creditor, and do everything for you)

So if you want your credit repaired properly, in the shortest time, and now (until Thursday 31 January 2019 at 5 pm QLD time) at the lowest lawyer rate in Australia, call MyCRA Lawyers NOW on 1300 667 218 and ask to get started NOW

Oh, I almost forgot to tell you how we worked out how to do it …

We have deconstructed our 9 years of success and reassembled it into 4 distinct stages

- Investigation

- Review

- Complaint

- Escalation

*************************************

have a look at a few previous success stories (Case Studies)

*************************************

We discovered that a large number of our clients get their defaults removed in the initial investigation stage

because by now most creditors know about MyCRA Lawyers long-standing reputation to keep working until the default is removed,

and because there is every chance we have successfully beaten your creditor many times by now, they will often make a commercial decision to remove the default sooner than later

because they know when you choose MyCRA Lawyers to represent you,

you’ll probably be successful anyway, and it makes no sense for them to waste money fighting a fight they will most likely lose anyway.

So in Stage One: (Other clients are normally billed over $2000 for this first stage)

- You will get started TODAY by getting your verbal agreement to save you valuable time to ensure you don’t miss out on this amazing saving

- We will open your file

- We will Conduct a full and in-depth review of your credit files from at least two Credit Reporting Bodies (we can get the credit files if you don’t have them already)

- We will ensure your safety and draft a full client agreement and disclosure notice specific to you and your matter and email it out to you for your records

- You will answer a few questions to give your dedicated Lawyer as much information as you can remember

- We will research the specifics of your creditor

- We will compile the years of historical knowledge about your creditor from all previous cases against your creditor (our previous clients and court cases)

- We will Draft the initial contact letter to your creditor (awaiting the return of your signed authority by email) to include the relevant information that will best help have your default removed in the shortest possible time

- We will send your initial contact letter to your creditor after it has been reviewed by our Senior Partner Mr Patrick Earl (Most Senior and Most Respected Lawyer in our Firm) as a final quality assurance check.

- We will chase and follow up your creditor for a default removal resolution

- We will keep you informed every step of the way for your peace of mind

*************************************

have a look at a few previous success stories (Case Studies)

*************************************

So, if you can see the value of getting started now, please stop what you are doing, pick up your mobile right now and press 1300 667 218 right now to speak to one of my team, or leave a message to have one of my team call you back (in the order the calls are received so get in fast) and remember, if the lines are busy, please keep trying and call back on 1300 667 218 now.

Welcome to 2019!

Graham

***********************************************

More about Graham Doessel

Proudly Supporting

The Sanity Space

Foundation

National Sponsor of

The Small Business

Association Of

Australia

Armstrong Doessel Stevenson

LAWYERS

Family Law

Commercial Litigation

Debt Collection

DOWNLOAD Our

Family Law FIVE

Brochure

- MyCRA Lawyers is more expensive; but

- You get a certified Practicing Lawyer removing your default when you choose MyCRA Lawyers; and

- Most defaults are removed in 30 days or less; with almost a 1/3 getting their removal resolution in just 7 days or less

(If you act now, you might qualify to engage the Best for less than you pay an unlicensed credit repair agency)

(So, do your research, check out the unlicensed credit repair agencies and their outlandish and unsubstantiated claims [they’re popping up everywhere like weeds in the garden], and then do what most people do, and choose the safe [and legal] path and ask MyCRA Lawyers to consider removing your default for you)

- Call 1300 667 218 right now; and

- Get started from as little as $1497 today; and

- You could have clean credit before you know it!

- I find it hard to talk about myself

- I hide away from people and I set up my office in the storeroom

- My Wife Helen keeps me sane, and giving my kids Steph, Cory and Joel better opportunities than I had are why I work such crazy long hours

- I am a cancĕr survivor (9 years now)

- I am FBAA’s Vice President for QLD and NT

- I am a JP Qualified

- I am a Law Student

- I was Scared Sh*tless when Steph (my Daughter) said I was going to be a Grandad – And I resisted because I saw Grandparents as OLD, and I was in my 40’s

- I was a Mortgage Broker from 1997 to 2010

- I closed it [mortgage now] down after being diagnosed with (and beating) cancĕr

- I reregistered as a broker in 2016 so I could keep my CPD up so I better understand what my referring brokers are going through and help them with non-conforming scenarios.

- I don’t know what else to write about…

have a look at a few previous

success stories (Case Studies)

*************************************

Call my team on 1300 667 218 today, you’ll be glad you did!* The up to 58.6% saving is the difference between 15 hours at our Solicitors Standard Hourly Rate and MyCRA lawyers Unique fixed fee credit repair option calculation that you may qualify for if you complete the form.

With warm regards,

MyCRA Lawyers

Graham Doessel

Chief Executive Officer

Legal Practice Holdings

Tel: 1300 667 218

Legal Practice Holdings Pty Ltd ta MyCRA Lawyers – 246 – 256 Stafford Road, Stafford, Qld.4053 | Tel: 1300 667 218

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

![Hey did you see this? [case study email]](https://mycralawyers.com.au/wp-content/uploads/2019/03/case-study-banner.jpg)

And You Might Also Think That All Of This Wisdom, Experience, Expertise, Training, Research, Dedication And Commitment to Removing Your Bad Credit Quicker And More Consistently Than Anyone Else In Australia, Would Come At A Very Reasonable Price Point… And You’d Be Right Again.

And You Might Also Think That All Of This Wisdom, Experience, Expertise, Training, Research, Dedication And Commitment to Removing Your Bad Credit Quicker And More Consistently Than Anyone Else In Australia, Would Come At A Very Reasonable Price Point… And You’d Be Right Again.

[/fusion_imageframe][fusion_title size=”2″ content_align=”left” style_type=”double solid” sep_color=”#d4af37″ margin_top=”10px” margin_bottom=”10px” class=”” id=””]Testimonial[/fusion_title][fusion_text]

[/fusion_imageframe][fusion_title size=”2″ content_align=”left” style_type=”double solid” sep_color=”#d4af37″ margin_top=”10px” margin_bottom=”10px” class=”” id=””]Testimonial[/fusion_title][fusion_text]

[/fusion_imageframe][fusion_imageframe lightbox=”yes” lightbox_image=”” style_type=”bottomshadow” hover_type=”zoomin” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”up” animation_speed=”1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]

[/fusion_imageframe][fusion_imageframe lightbox=”yes” lightbox_image=”” style_type=”bottomshadow” hover_type=”zoomin” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”up” animation_speed=”1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]  [/fusion_imageframe][fusion_title size=”2″ content_align=”left” style_type=”double solid” sep_color=”#d4af37″ margin_top=”10px” margin_bottom=”10px” class=”” id=””]Testimonial[/fusion_title][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”yes” overflow=”visible” type=”flex”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” align_self=”flex-start” border_sizes_undefined=”” first=”true” last=”true” hover_type=”none” link=”” border_position=”all”][fusion_section_separator divider_candy=”bottom” icon=”” icon_color=”” bordersize=”1px” bordercolor=”#333333″ backgroundcolor=”#333333″ class=”” id=”” /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container background_color=”” background_image=”https://mycralawyers.com.au/wp-content/uploads/2015/09/bkgd_bw2.jpg” background_parallax=”fixed” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” video_mute=”yes” video_loop=”yes” fade=”no” border_color=”#e5e4e4″ border_style=”solid” padding_top=”65px” padding_bottom=”50px” padding_left=”20px” padding_right=”20px” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=”” type=”flex” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” align_self=”flex-start” border_sizes_undefined=”” first=”true” last=”true” hover_type=”none” link=”” border_position=”all”][fusion_title size=”2″ content_align=”left” style_type=”double solid” sep_color=”#d4af37″ margin_top=”10px” margin_bottom=”10px” class=”” id=””]Testimonial[/fusion_title][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ last=”false” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”true” spacing_right=”2%” min_height=””][fusion_testimonials design=”classic” backgroundcolor=”” textcolor=”” random=”” class=”” id=””][fusion_testimonial name=”Jess” avatar=”female” image=”” image_border_radius=”” company=”Qld” link=”” target=”_self”]Thank you so much for a great service that was professional and very prompt.[/fusion_testimonial][/fusion_testimonials][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ last=”false” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”false” spacing_right=”2%” spacing_left=”2%” min_height=””][fusion_testimonials design=”classic” backgroundcolor=”” textcolor=”” random=”” class=”” id=””][fusion_testimonial name=”Sean” avatar=”male” image=”” image_border_radius=”” company=”NSW” link=”” target=”_self”]thanks a lot for stellar results on the client I referred Friday. Credit Card Default from a trigger happy major was removed in 3 days. Impressive[/fusion_testimonial][/fusion_testimonials][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ last=”true” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”false” spacing_left=”2%” min_height=””][fusion_testimonials design=”classic” backgroundcolor=”” textcolor=”” random=”” class=”” id=””][fusion_testimonial name=”Joseph” avatar=”male” image=”” image_border_radius=”” company=”WA” link=”” target=”_self”]I would like to inform you that, after spoken to you yesterday, I called Veda and they told me that my credit default has been removed. I also ordered for my new credit report and indeed the Optus default listing was not there, plus my credit score went up 546 – 716%. I Just want to thank you guys for following up

[/fusion_imageframe][fusion_title size=”2″ content_align=”left” style_type=”double solid” sep_color=”#d4af37″ margin_top=”10px” margin_bottom=”10px” class=”” id=””]Testimonial[/fusion_title][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container hundred_percent=”yes” overflow=”visible” type=”flex”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” align_self=”flex-start” border_sizes_undefined=”” first=”true” last=”true” hover_type=”none” link=”” border_position=”all”][fusion_section_separator divider_candy=”bottom” icon=”” icon_color=”” bordersize=”1px” bordercolor=”#333333″ backgroundcolor=”#333333″ class=”” id=”” /][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container][fusion_builder_container background_color=”” background_image=”https://mycralawyers.com.au/wp-content/uploads/2015/09/bkgd_bw2.jpg” background_parallax=”fixed” enable_mobile=”no” parallax_speed=”0.3″ background_repeat=”no-repeat” background_position=”left top” video_url=”” video_aspect_ratio=”16:9″ video_webm=”” video_mp4=”” video_ogv=”” video_preview_image=”” overlay_color=”” video_mute=”yes” video_loop=”yes” fade=”no” border_color=”#e5e4e4″ border_style=”solid” padding_top=”65px” padding_bottom=”50px” padding_left=”20px” padding_right=”20px” hundred_percent=”no” equal_height_columns=”no” hide_on_mobile=”no” menu_anchor=”” class=”” id=”” type=”flex” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px”][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ background_position=”left top” background_color=”” border_color=”” border_style=”solid” spacing=”yes” background_image=”” background_repeat=”no-repeat” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”0px” margin_bottom=”0px” class=”” id=”” animation_type=”” animation_speed=”0.3″ animation_direction=”left” hide_on_mobile=”no” center_content=”no” min_height=”none” align_self=”flex-start” border_sizes_undefined=”” first=”true” last=”true” hover_type=”none” link=”” border_position=”all”][fusion_title size=”2″ content_align=”left” style_type=”double solid” sep_color=”#d4af37″ margin_top=”10px” margin_bottom=”10px” class=”” id=””]Testimonial[/fusion_title][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ last=”false” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”true” spacing_right=”2%” min_height=””][fusion_testimonials design=”classic” backgroundcolor=”” textcolor=”” random=”” class=”” id=””][fusion_testimonial name=”Jess” avatar=”female” image=”” image_border_radius=”” company=”Qld” link=”” target=”_self”]Thank you so much for a great service that was professional and very prompt.[/fusion_testimonial][/fusion_testimonials][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ last=”false” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”false” spacing_right=”2%” spacing_left=”2%” min_height=””][fusion_testimonials design=”classic” backgroundcolor=”” textcolor=”” random=”” class=”” id=””][fusion_testimonial name=”Sean” avatar=”male” image=”” image_border_radius=”” company=”NSW” link=”” target=”_self”]thanks a lot for stellar results on the client I referred Friday. Credit Card Default from a trigger happy major was removed in 3 days. Impressive[/fusion_testimonial][/fusion_testimonials][/fusion_builder_column][fusion_builder_column type=”1_3″ layout=”1_3″ last=”true” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_color=”” border_style=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=”” border_sizes_top=”0px” border_sizes_bottom=”0px” border_sizes_left=”0px” border_sizes_right=”0px” first=”false” spacing_left=”2%” min_height=””][fusion_testimonials design=”classic” backgroundcolor=”” textcolor=”” random=”” class=”” id=””][fusion_testimonial name=”Joseph” avatar=”male” image=”” image_border_radius=”” company=”WA” link=”” target=”_self”]I would like to inform you that, after spoken to you yesterday, I called Veda and they told me that my credit default has been removed. I also ordered for my new credit report and indeed the Optus default listing was not there, plus my credit score went up 546 – 716%. I Just want to thank you guys for following up

[/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_imageframe lightbox=”yes” lightbox_image=”” style_type=”bottomshadow” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”up” animation_speed=”1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]

[/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_imageframe lightbox=”yes” lightbox_image=”” style_type=”bottomshadow” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”up” animation_speed=”1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]  [/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_imageframe lightbox=”yes” lightbox_image=”” style_type=”bottomshadow” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”up” animation_speed=”1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]

[/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” hover_type=”none” link=”” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ animation_offset=”” class=”” id=””][fusion_imageframe lightbox=”yes” lightbox_image=”” style_type=”bottomshadow” hover_type=”none” bordercolor=”” bordersize=”0px” borderradius=”0″ stylecolor=”” align=”center” link=”” linktarget=”_self” animation_type=”fade” animation_direction=”up” animation_speed=”1″ animation_offset=”” hide_on_mobile=”no” class=”” id=””]

[/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]

[/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”no” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][/fusion_builder_column][fusion_builder_column type=”1_2″ last=”yes” spacing=”yes” center_content=”no” hide_on_mobile=”no” background_color=”” background_image=”” background_repeat=”no-repeat” background_position=”left top” border_position=”all” border_size=”0px” border_color=”” border_style=”” padding=”” margin_top=”” margin_bottom=”” animation_type=”” animation_direction=”” animation_speed=”0.1″ class=”” id=””][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]